Today's news

News, current affairs and hot information

The Israeli-Palestinian conflict refers to the long-standing conflict between Israel and Palestine. The conflict began in the early 20th century and has continued for nearly a century. It involves many aspects such as territory, religion, history, and politics, resulting in numerous violent incidents and casualties. Shipping oil prices have also been significantly affected.

Amid the Palestinian-Israeli conflict, how does the International Energy Agency assess the direction of the oil market?

In its latest monthly oil market report, the International Energy Agency (IEA) said that although the conflict between Palestine and Israel has not had a direct impact on crude oil supply, energy market participants will still feel "like sitting on pins and needles" as the crisis spreads.

As the new round of Palestine-Israel conflict continues, the geopolitical risk escalates sharply, and investors are closely monitoring the risk of possible oil supply disruption in the Middle East.

According to Xinhua News Agency, since the outbreak of a new round of conflict between Palestine and Israel, approximately 2,200 people have been killed and more than 8,000 injured by both sides.

The International Energy Agency (IEA) said in its latest monthly oil market report on Thursday (12th) that although the conflict between Palestine and Israel has not had a direct impact on crude oil supply, energy market participants will still feel "like sitting on pins and needles" as the crisis spreads. IEA said in the report: "The conflict in the Middle East is full of uncertainty, and things are developing rapidly." At the same time, IEA has downgraded its global oil demand growth expectations for 2024.

How will the international oil price trend in the future? "If global economic growth remains sluggish, the outlook for oil demand will become even more gloomy, and the impact of geopolitics will add pressure on the further decline of international oil prices." said Anguangyong, expert member of the Credit Management Committee of the All-China Association of Mergers and Acquisitions, to the First Financial Journalist.

Bai Wenxi, chief economist of IPG China, told First Financial News: "The follow-up trend of international oil prices will be affected by various factors and need to be considered comprehensively.

<1>Container shipping and bulk shipping

If the Palestinian-Israeli conflict expands beyond its borders, it will pose risks to the Suez Canal and the Strait of Hormuz, two key shipping channels. The Suez Canal is a key waterway for all types of merchant ships, and the Strait of Hormuz is crucial for the transportation of oil and natural gas.

If the canal is closed due to regional conflicts, ships will have to circumnavigate Africa, which will lengthen the route and help absorb available capacity and drive up freight rates.

The volume of the container transportation market in the Israeli-Palestinian region itself is not large. Linerlytica, a shipping consulting company, said on Monday that the container throughput of the main ports in Ashdod and Haifa accounts for only 0.4% of the world's total. ZIM, the world's tenth largest liner company, is headquartered in Haifa. The company confirmed on Wednesday that its Israeli route service may be interrupted and will charge a war risk surcharge.

Similarly, the bulk transport sector is only slightly affected by the conflict between Palestine and Israel, and the biggest impact may be the change in fuel costs caused by fluctuations in oil prices.

<2>Crude oil transportation

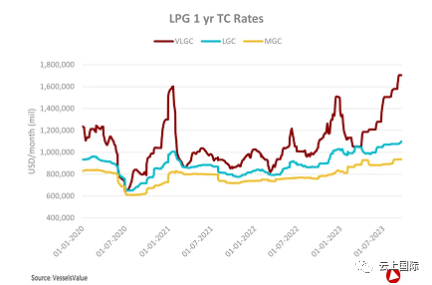

The VLGC freight rate may rise. LPG transported by VLGC is the raw material for steam cracking. The rise in oil prices after the war in the Middle East will drive up the price of naphtha and reduce its competitiveness, increasing Asia's demand for imported LPG, thereby boosting VLGC demand.

Ted Young, Chief Financial Officer of Dorian LPG, said,

If geopolitical conflicts continue to drive up oil prices, as long as they do not reach a level that suppresses demand, they will not have a negative impact on our business.

<3>Finished oil transportation

Robert Bugbee, President of Scorpio Tankers, pointed out that the current freight rate of product tankers has been higher than normal, and inventory is low. The geopolitical crisis will further drive up freight rates in winter.

After the COVID-19 epidemic, the consumption of gasoline, aviation fuel and other refined oil products has increased. Therefore, it is easy for energy shortages to occur globally.

<4>LNG transportation

At the same time, major LNG importers are adding floating storage regasification units (FSRU) to increase supply diversity, and the war in the Middle East should intensify this trend.

Art Regan, CEO of Energas Infrastructure, the owner of the FSRU, said that everyone is re-evaluating the energy matrix for the next 10-20 years, which is not related to energy transformation, but to energy security.